does tennessee have estate or inheritance tax

It is one of 38 states with no estate tax. No estate tax or inheritance tax.

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

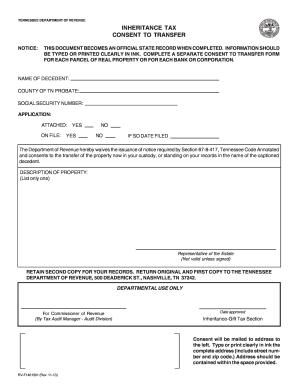

. Only seven states impose and inheritance tax. However there are additional tax returns that heirs and survivors must resolve for their deceased family members. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

Tennessee is an inheritance tax and estate tax-free state. All inheritance are exempt in the State of. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year. Connecticuts estate tax will have a flat rate of 12 percent by 2023. With the elimination of.

All inheritance are exempt in the State of Tennessee. Even though this is good news its not really that surprising. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

For deaths occurring in 2016 or later. Those who handle your estate following your death though do have some other tax returns to take care of such as. Up to 25 cash back Update.

Today Virginia no longer has an estate tax or inheritance tax. For example the neighboring state of Kentucky does have an inheritance tax. Tennessee is an inheritance tax-free state.

Tennessee does not have an estate tax. There are NO Tennessee Inheritance Tax. For all deaths that occurred in 2016 and thereafter no Tennessee inheritance tax is imposed.

There are NO Tennessee Inheritance Tax. What is the inheritance tax rate in Tennessee. It has no inheritance tax nor does it have a gift tax.

If the total Estate asset property cash etc is over 5430000 it is subject to the. Tennessee is an inheritance tax and estate tax-free state. If the person passed away in 2015 and value of the decedents gross estate was.

What is the state of Tennessee inheritance tax rate. Connecticuts estate tax will have a flat rate of 12. However if the value.

The inheritance and estate taxes wont be a.

State Death Tax Hikes Loom Where Not To Die In 2021

Tennessee Estate Tax Everything You Need To Know Smartasset

What Are Inheritance Taxes The Complete Guide Taxact

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Wayne Kramer Having To Avoiding Estate Inheritance Taxes History For Many

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Tennessee Retirement Tax Friendliness Smartasset

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee State Tax Guide Kiplinger

Moved South But Still Taxed Up North

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

11 Estate Taxes And Inheritance Planning Faqs Taxact Blog

Money Inheritance Document Pdf Form Fill Out And Sign Printable Pdf Template Signnow

What Is Inheritance Tax Probate Advance

How Much Is Inheritance Tax Community Tax

Do I Have To Pay A New York Inheritance Tax If My Parents Leave Me Their House Long Island Ny Estate Planning Attorneys

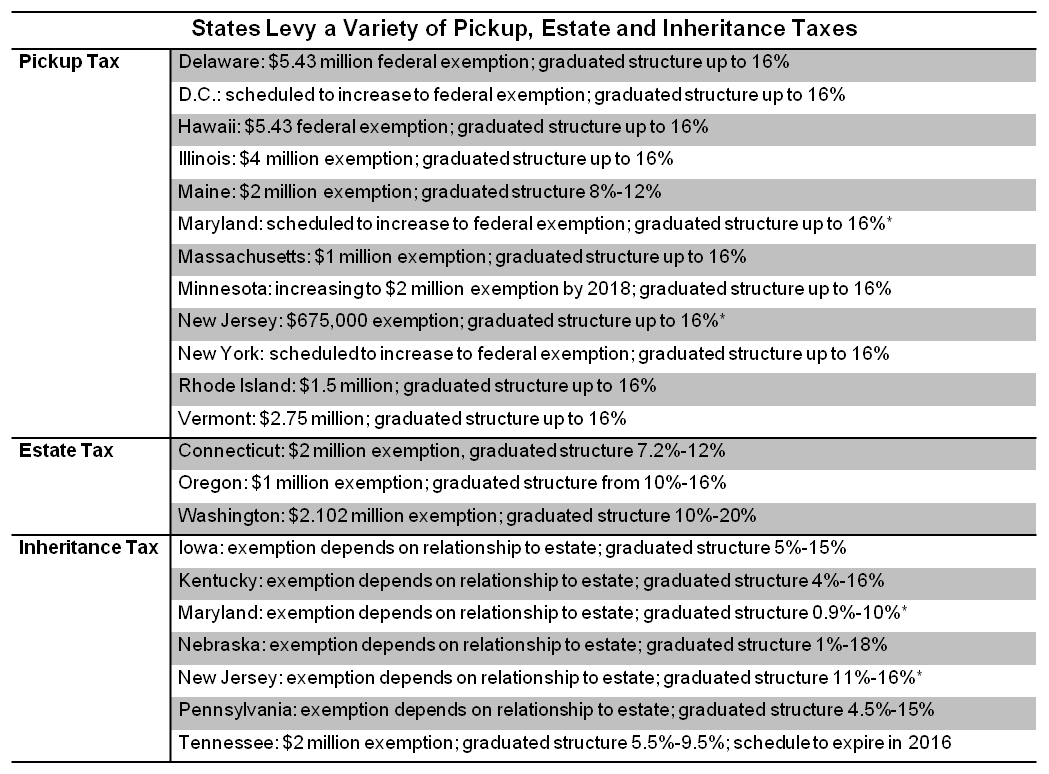

State Estate And Inheritance Taxes Itep

Reinstating Kentucky S Tax On Extreme Wealth A Part Of Making State Taxes Fair And Adequate Kentucky Center For Economic Policy

Does Your State Have An Estate Or Inheritance Tax Tax Foundation