is maine tax friendly to retirees

For nature lovers and those looking to retire in a place that offers the feeling of being far away from the rat race this may be the place. Hawaiis top rate of estate.

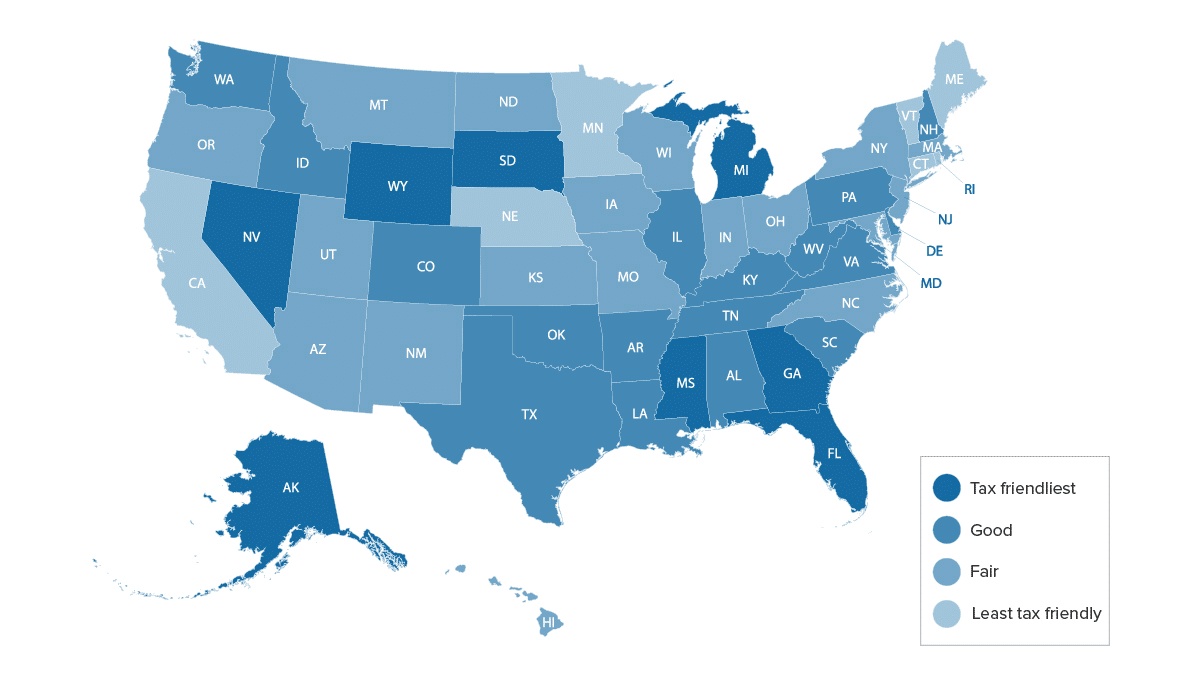

Least Tax Friendly States For Retirement Kiplinger S Personal Finance 03 17 14 Skloff Financial Group

State Sales Tax Rate.

. Average so when considered with an overall lower cost of living its a valuable investment to your health and well-being. Those are all good reasons to choose Maine as a retirement destination but what about the states tax system. States like Alaska Floriga Georgia and Nevada are some of the tax-friendliest for retirees.

According to Sperlings Best Places an online data resource the cost of housing. Most residents pay 104 percent of the propertys market value. Arizona Taxes on Retirees.

Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. The cost of healthcare is only 01 higher than the US. By Dennis Hoey Staff Writer.

See our Tax Map for. Social Security and public pensions are exempt from taxation but the Aloha State taxes private pensions and income from retirement saving plans at rates of up to 11. Married filers that both.

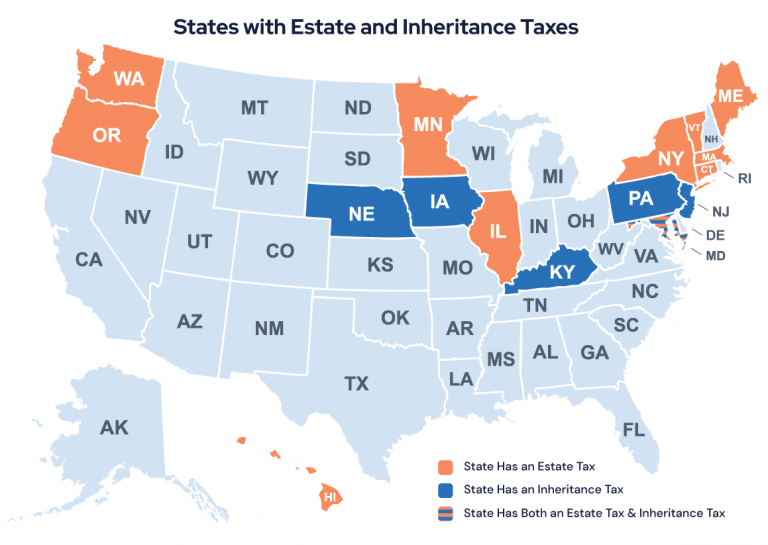

Estate and Inheritance Tax. Is Maine tax-friendly for retirees. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10.

Most residents pay 104 percent of the propertys market value. In this case the state is coming in at 6 due to it being quite tax friendly for retirees. The states property taxes are somewhat higher than the national average at a 130 effective rate.

Janet Mills signed into law Monday will provide property tax relief to thousands of Mainers who are 65 or older and earn less than 40000 per. 255 on up to 54544 of taxable income for married filers and up to 27272 for single filers. Sales taxes and property taxes are relatively moderate.

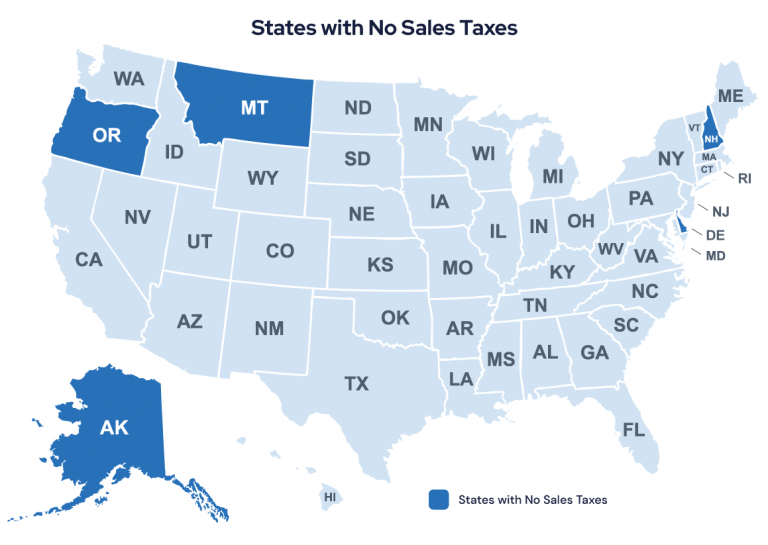

State Income Tax Range. Alaska holds the top spot in WalletHubs taxpayer ranking and also has the most elder-friendly work market for retirees who might want to earn extra income. In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill.

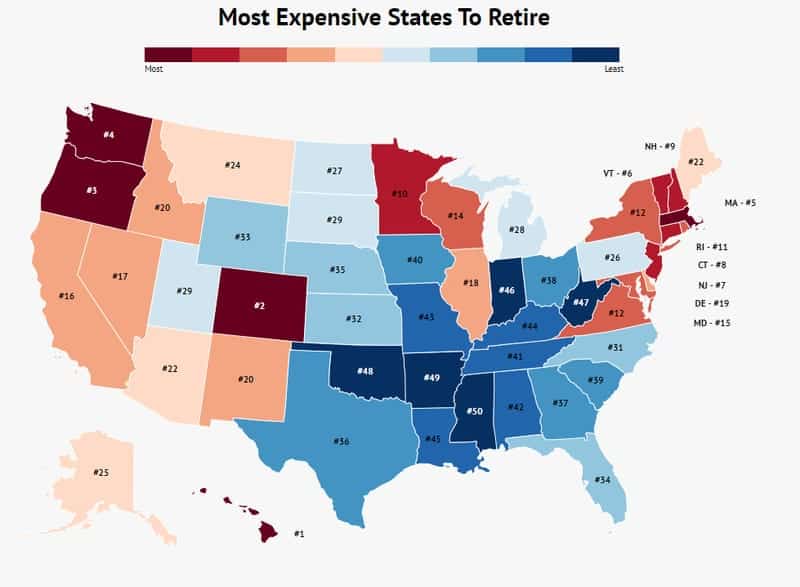

The state has the highest percentage of workers who are 65 years old or older. The worst state to retire in based on property taxes alone is New Jersey. This dollar amount ranks it highest in the nation by over 2500 a year.

It also has above average property taxes. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits.

For those of you who are or will be on a fixed income every dollar counts. How all 50 states rank for retirement friendliness. The state taxes at a 249 rate and the average property tax bill is 8362.

On the other hand taxes in a state like Nebraska which taxes all retirement income and has high property tax rates the overall state and local tax bill for a senior could be thousands of dollars higher. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. One of the amazing benefits of retiring in Maine is that our healthcare system is made up of some of the best hospitals and healthcare providers available.

Is my retirement income taxable to Maine. Social Security is exempt from taxation in Maine but other forms of retirement income are not. Low property tax is especially important for many retirees who may live in larger homes but have limited income streams.

Is maine a tax friendly state for retirees.

A Guide To The Best And Worst States To Retire In

A Guide To The Best And Worst States To Retire In

The Most Tax Friendly States For Retirees Vision Retirement

Vermont Among Least Tax Friendly States Vermont Business Magazine

7 States That Do Not Tax Retirement Income

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

Maine Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Don T Retire In These 10 States If You Want To Keep Your Money The Most Expensive States To Retire Zippia

A Guide To The Best And Worst States To Retire In

Most Tax Friendly States For Retirees Ranked Goodlife

Maine Retirement Tax Friendliness Smartasset

Best States To Retired In With The Lowest Cost Of Living Finance 101

Skowhegan Caribou Top Ranking Of Tax Friendly Places To Retire In Maine

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

Best States To Live In Retirement

Maine Retirement Tax Friendliness Smartasset